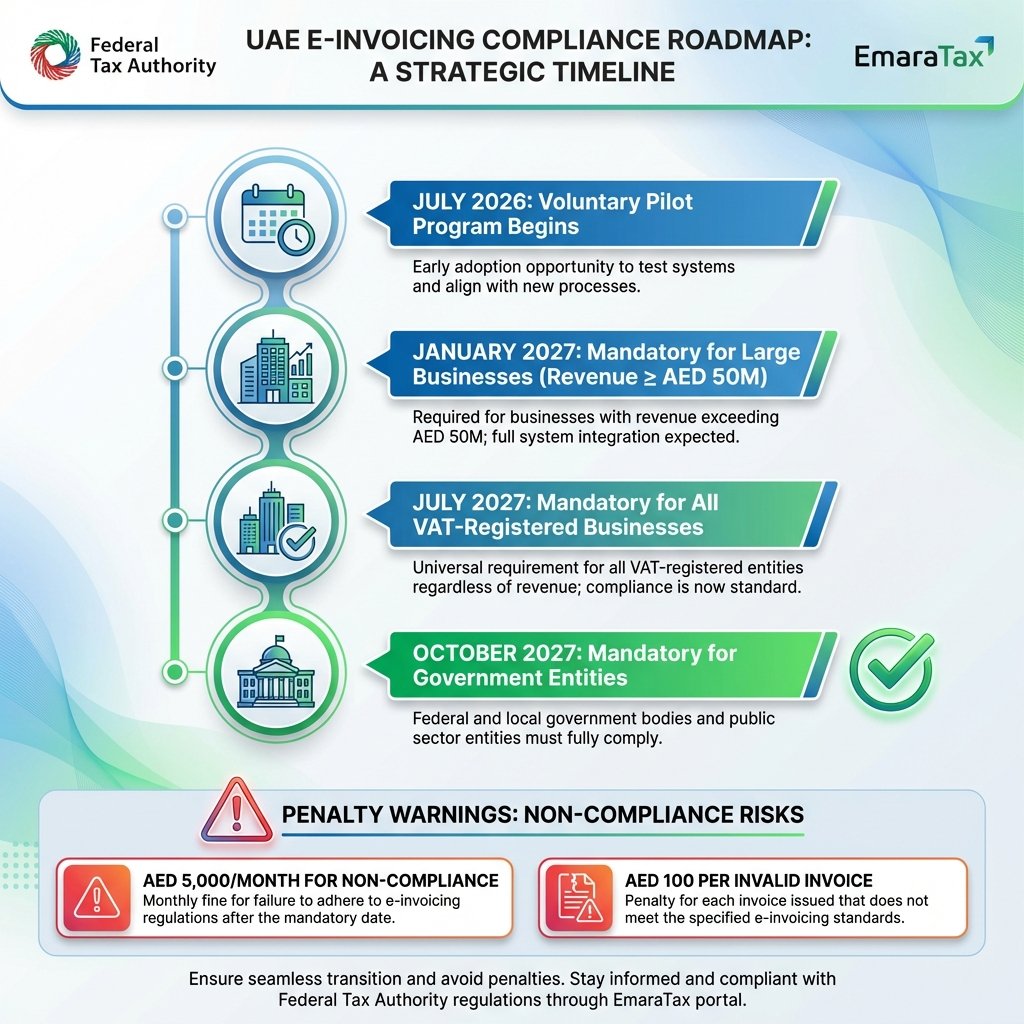

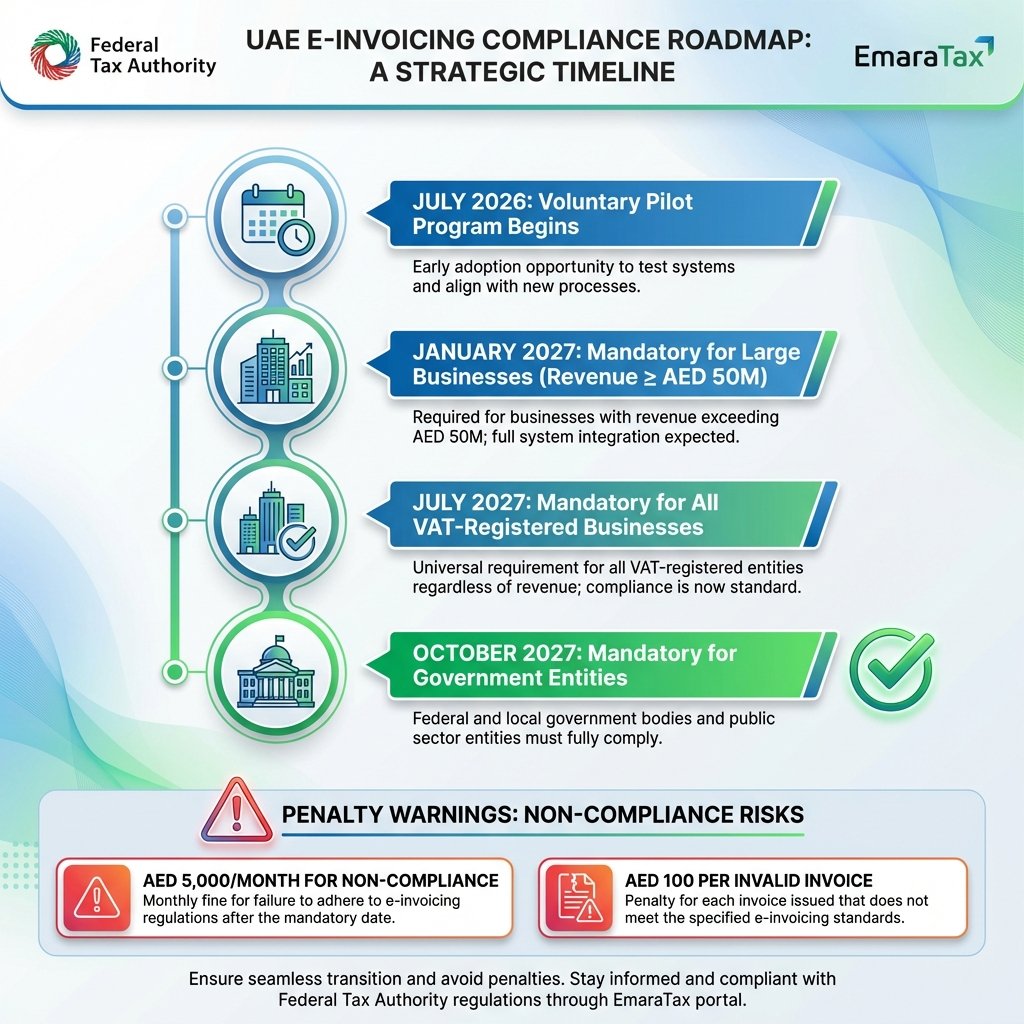

UAE E-Invoicing Compliance Timeline

Understand the key deadlines and prepare your business for mandatory compliance

Navigate the EmaraTax transition with confidence. POSOne helps your business meet Federal Tax Authority requirements on time.

Download Free Compliance GuideUnderstand the key deadlines and prepare your business for mandatory compliance

Beyond avoiding penalties, e-invoicing transforms your business operations

Non-compliance costs AED 5,000/month plus AED 100 per invalid invoice. Protect your business from unnecessary fines.

Automate invoice processing, reduce manual errors, and speed up payment cycles with digital workflows.

Gain instant insights into your invoicing status, VAT reporting, and compliance metrics.

Peppol compatibility enables seamless international trade and invoice exchange across borders.

Accurate, compliant e-invoices expedite VAT refund processing from the Federal Tax Authority.

Digital signatures and encrypted transmission protect your sensitive business data.

Comprehensive compliance solutions tailored to your business needs

Get your comprehensive 20-page guide to UAE E-Invoicing compliance

EmaraTax is the UAE Federal Tax Authority's mandatory e-invoicing system that requires all VAT-registered businesses to issue invoices digitally through the Peppol network using the DCTCE (Decentralized Continuous Transaction Control & Exchange) model.

The rollout is phased: January 2027 for large businesses (revenue ≥ AED 50M), July 2027 for all other VAT-registered businesses, and October 2027 for government entities.

Businesses face AED 5,000 per month for failing to implement the system, plus AED 100 for each invoice not issued in the required format (capped at AED 5,000/month per category).

Yes, all businesses must contract with an FTA-accredited service provider to facilitate e-invoicing compliance. POSOne can help you select and integrate with the right ASP for your business.

Most modern POS systems can be upgraded or integrated with e-invoicing solutions. POSOne will assess your current system and recommend the best path forward, whether that's an upgrade, integration, or replacement.

Implementation timelines vary based on business size and complexity, typically ranging from 2-8 weeks. We recommend starting at least 3-6 months before your compliance deadline to ensure a smooth transition.

Don't wait until the deadline. Start your e-invoicing journey today.

📞 Call Us: +971 50 363 5757Or email us at sales@posonepos.com